Weekday performance saved an otherwise lackluster week across the U.S. hotel industry. Occupancy was essentially flat for the week with weekdays (Monday through Wednesday) up and the rest of the week down. Average daily rate (ADR) continued to rise, pushing gains in revenue per available room (RevPAR) for the fifth straight week, albeit at a rate below the level of inflation. Five seemed to be the magic number as Top 25 Market RevPAR also rose for the fifth consecutive week, lifted by weekdays over each of the past five weeks. Five of the six chain scales (all but Economy) increased weekday RevPAR, and group demand increased for the fifth week in a row.

Weekday performance countered a slow weekend

U.S. RevPAR was up a modest 0.9% YoY due to increasing ADR (+1.0%). Occupancy dipped a miniscule -0.1 percentage points (ppts). RevPAR in the Top 25 Markets (+2.1%) counteracted the nearly flat RevPAR (+0.1%) experienced across the rest of the country. Top 25 Market occupancy rose 0.8% and ADR increased 0.9%. Weekday performance in the Top 25 was the real winner with a RevPAR gain of +3.8%. Markets outside the Top 25 also posted weekday RevPAR gains (+1.2%). Weekend (Friday and Saturday) RevPAR was down both in the Top 25 Markets (-0.4%) and the rest of the U.S. (-1.2%).

Weekdays lifted RevPAR across all chain scales except Economy

Bifurcation continued across the chain scales with RevPAR rising in Upper Upscale (+2.8%) and Luxury (+1.2%) hotels. The next two chain scales maintained positive RevPAR comparisons, just barely, while Midscale and Economy declined for the entire week. Weekday RevPAR improved across the top five chain scales following the same pattern seen across the chain scales overall. ADR drove weekday gains, an indication of decent pricing power as business travel continued to strengthen.

Houston’s growth streak holds for the sixth week in a row

Double-digit RevPAR growth was seen in four of the Top 25 Markets with Houston (+53.8%) earning top honors for the sixth consecutive week. Minneapolis was a distant yet robust second at +22.7%, strengthened by a packed concert calendar followed by Chicago (+18.7%) preparing for the Democratic National Convention and New Orleans placing it in the top five for RevPAR growth a sixth time in the past seven weeks.

Healthy group performance propelled by weekdays

Group demand in Luxury and Upscale hotels was up for the fifth week in a row. In the most recent week, group demand increased 8.7% and ADR advanced 4.0%. Weekdays were the primary driver where group demand increased 11.8%. Shoulder and weekends were also strong, up 9.1% and 3.1%, respectively. ADR increases were more balanced with weekend ADR (+4.4%) followed by weekdays (+4.0%) and shoulder days (+3.7%).

The Top 25 Markets were responsible for the gain in group demand, up 16.8% while ADR increased 4.5%. Across the rest of the country, group demand was essentially unchanged while ADR increased 3.6%. Twenty of the Top 25 Markets saw group demand growth with Anaheim (Orange County), San Diego, Orlando and Dallas all increasing by more than five percentage points in group occupancy.

Transient performance across Luxury and Upper Upscale hotels was soft for the second consecutive week with demand down 0.5% and ADR up 0.5%. Weekdays helped lift ADR (+1.7%) while weekday demand was down (-0.4%).

Paris maintained momentum, London welcomed Taylor Swift

Global hotel performance continued to advance with RevPAR at +6.6% driven primarily by a 5.8% rise in ADR, while occupancy rose slightly (+0.6ppts to 73.1%). This marks a slight dip from the previous week’s yearly high of 74.0%.

Indonesia led the largest global hotel markets in RevPAR growth with a 23.2% increase. The strong performance was driven by gains in 11 out of its 12 markets with Southern Sumatra and Kalimantan seeing the most significant growth at +52.3% and +49.4%, respectively. Ongoing high demand from international travelers, as well as robust corporate and government domestic demand, continued to fuel this positive trend across the country.

Occupancy and ADR continued to fall in China with RevPAR down 9.8% in the week. RevPAR has fallen in the past eight consecutive weeks and in 25 of the past 33 weeks. RevPAR was down this week in 33 of China’s 43 markets with the seven largest markets (Beijing, Guangdong, Guangzhou, Hangzhou, Jiangsu, Shandong, and Shanghai) seeing RevPAR losses of more than 11%.

Paris occupancy increased 10.1ppts to 77.5% on Sunday of the Olympic closing ceremony with ADR soaring up 116%. A drill-down across all days of the Olympics can be viewed here. Over the entire week, Paris saw occupancy decline 7.8ppts, offset by a 27.2% gain in ADR resulting in positive RevPAR comparison (+12.3%). Outside of Paris, all other markets saw occupancy increases, with the largest gains in the southeastern regions: Auvergne-Rhone-Alpes up 10.3ppts to 72.8%, and Bourgogne-Franche-Comté up 16.7ppts to 81.0%. The biggest ADR uplift (+46.6%) occurred in the surrounding Île-de-France region.

In the U.K., the week’s results included three of the five nights of Taylor Swift’s Eras Tour in London. During the concert nights (Thursday to Saturday), London ADR increased 21% and occupancy rose 7ppts. In contrast, for the rest of the week, occupancy was up only 2ppts with ADR rising 6%.

Looking ahead

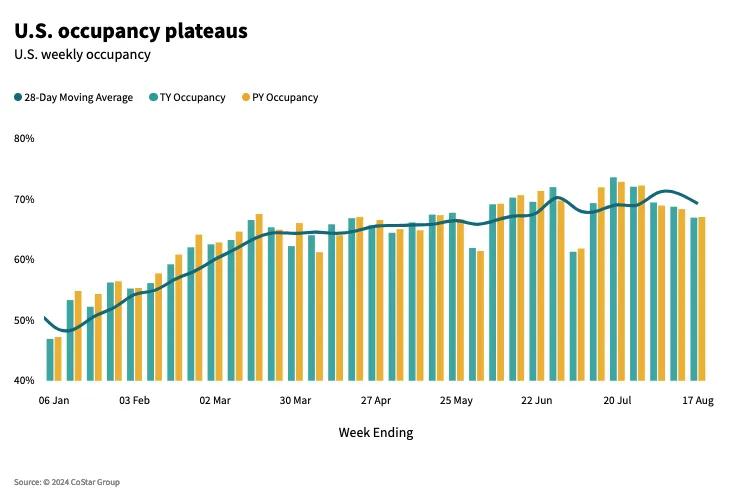

We expect U.S. occupancy to continue a seasonal slowdown until after Labor Day week. This summer’s healthy group performance will wane, as is typical this time of year, before ramping back up in September. The strengthening of weekday performance serves as a positive indication that business travel will continue to be counterbalanced by soft weekend performance, which is expected to persist in the coming months. Calendar shifts in the Jewish observance of Rosh Hashana and Yom Kippur will impact September and October, and the week of the U.S. election on 5 November is expected see reduced demand as evidenced by future occupancy on the books recorded by STR’s Forward STAR. Good news for Miami, New Orleans and Indianapolis along with Toronto and Vancouver is the return of Taylor Swift’s Eras Tour this year.

Global performance will slow as summer comes to an end in the northern hemisphere. London will get a final boost from Taylor Swift’s last two shows. All indications are that China will continue to see soft performance.